Enterprise VAT management made easy

VATBox by Blue dot identifies and calculates any eligible and qualified VAT spend. Optimise, manage, and analyse your company’s global and local VAT recovery processes while identifying unclaimed returns and avoidable costs.

“Blue dot VATBox transformed our process from a manual, decentralised workflow into a centralised digitised global process.”

– Jose-Manuel Pedron-Garcia

Global Tax Compliance Process Leader, Michelin

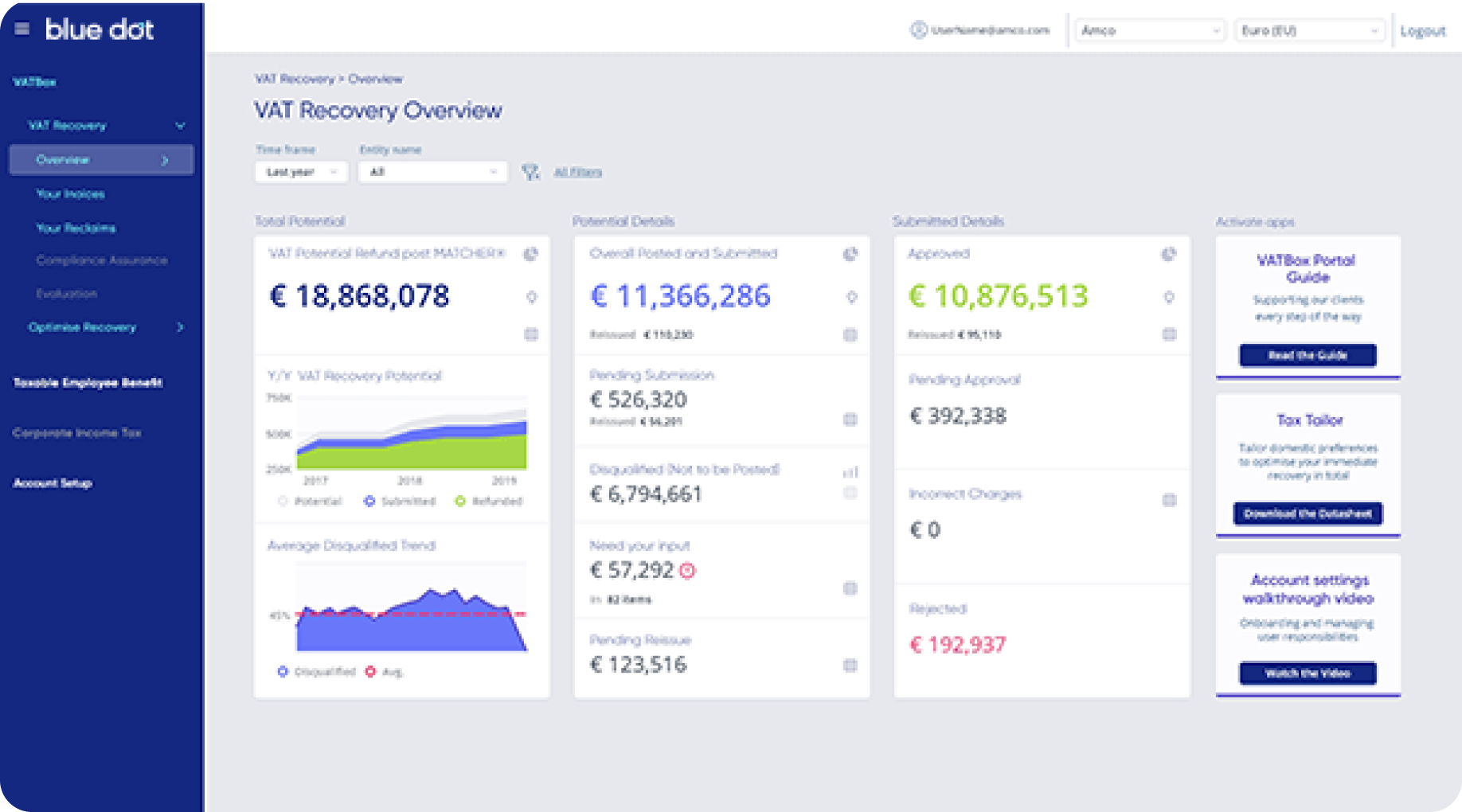

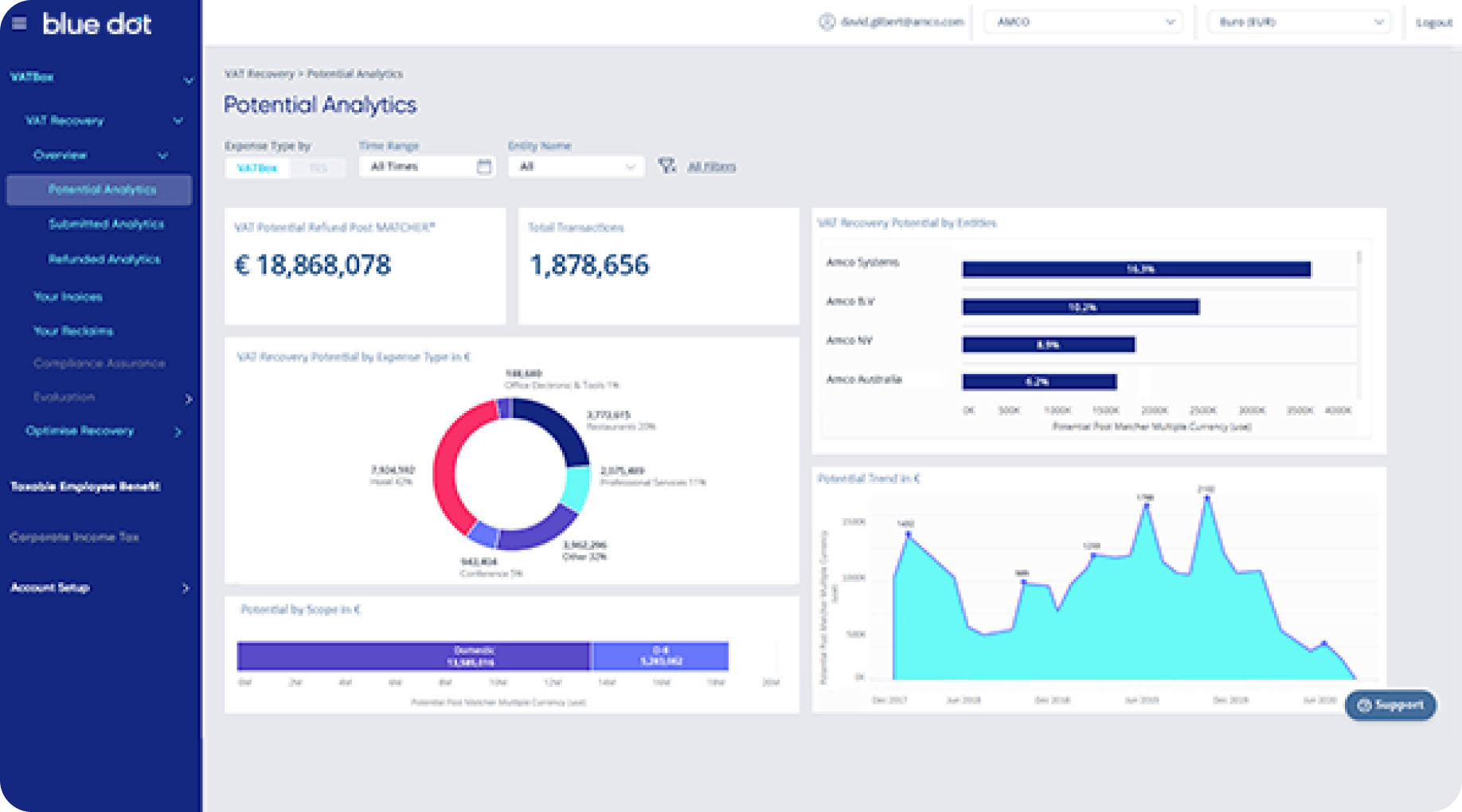

VAT assurance powered by VATBox

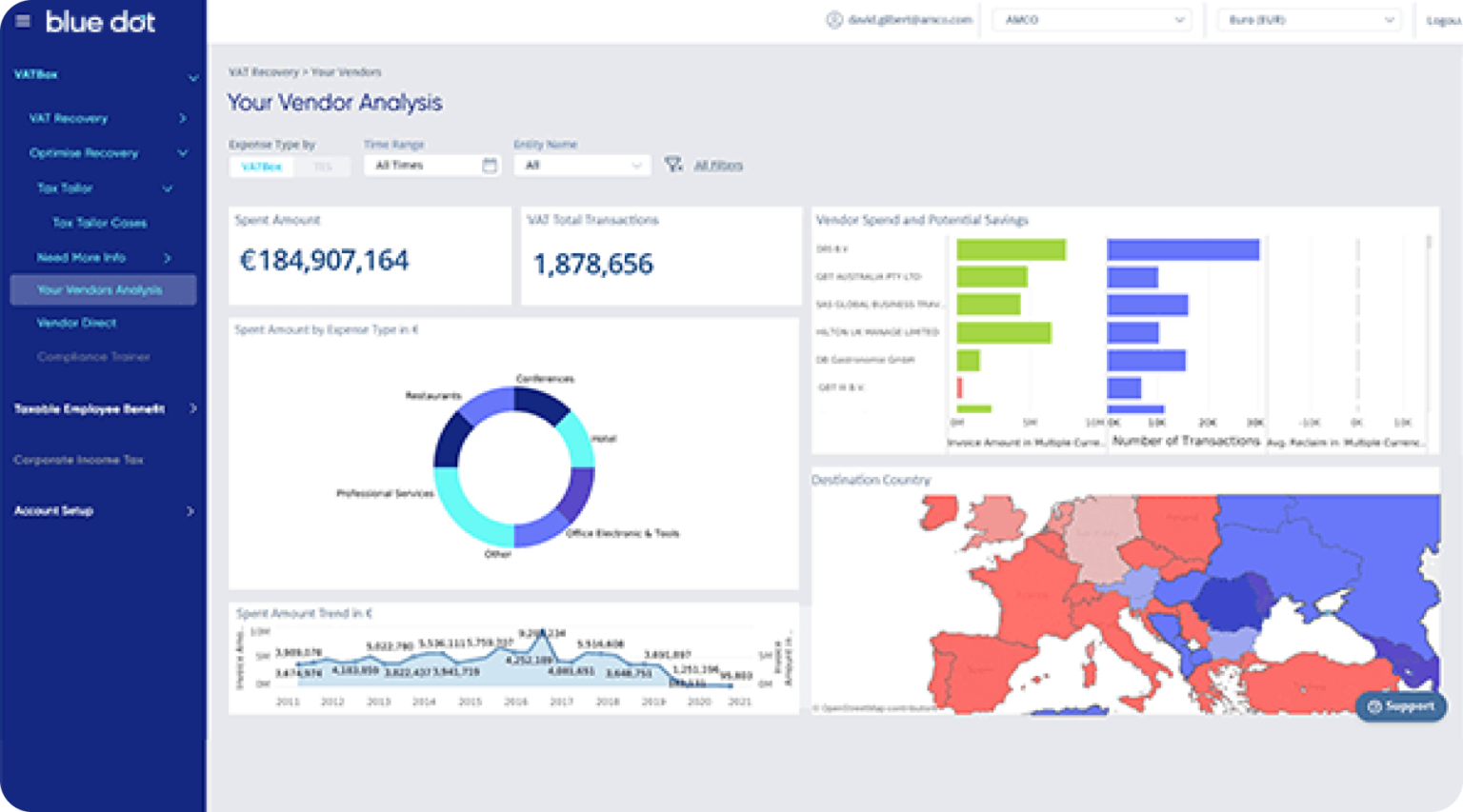

- Benefit from a breakdown of your invoices and VAT reclaims, and gain an in-depth overview of all VAT reclaim statuses

- Easily navigate to the different sections of the VATBox Portal to gain insight into your transactional data and VAT submissions

- Exploit the available business applications to optimise and increase your VAT recovery potential

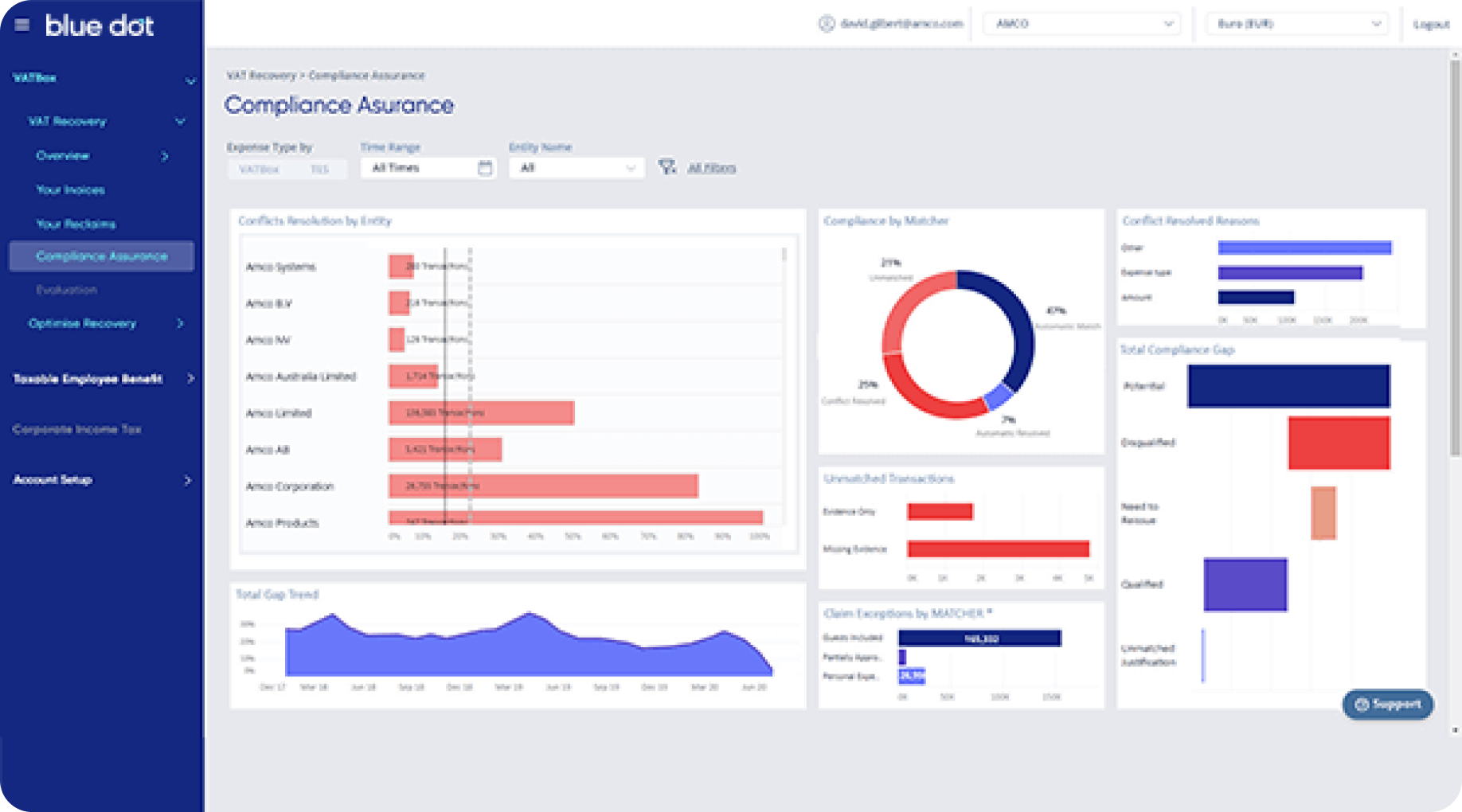

Compliance assurance

- Gain insights into gap trends and learn where to focus your compliance efforts based on previous conflicts

- Ensure the highest compliance rate by using our triple QA mechanism to extract, match and analyse every invoice

- Leverage powerful analytics and actionable insights that support informed data-driven decisions while ensuring full compliance with tax and financial authorities

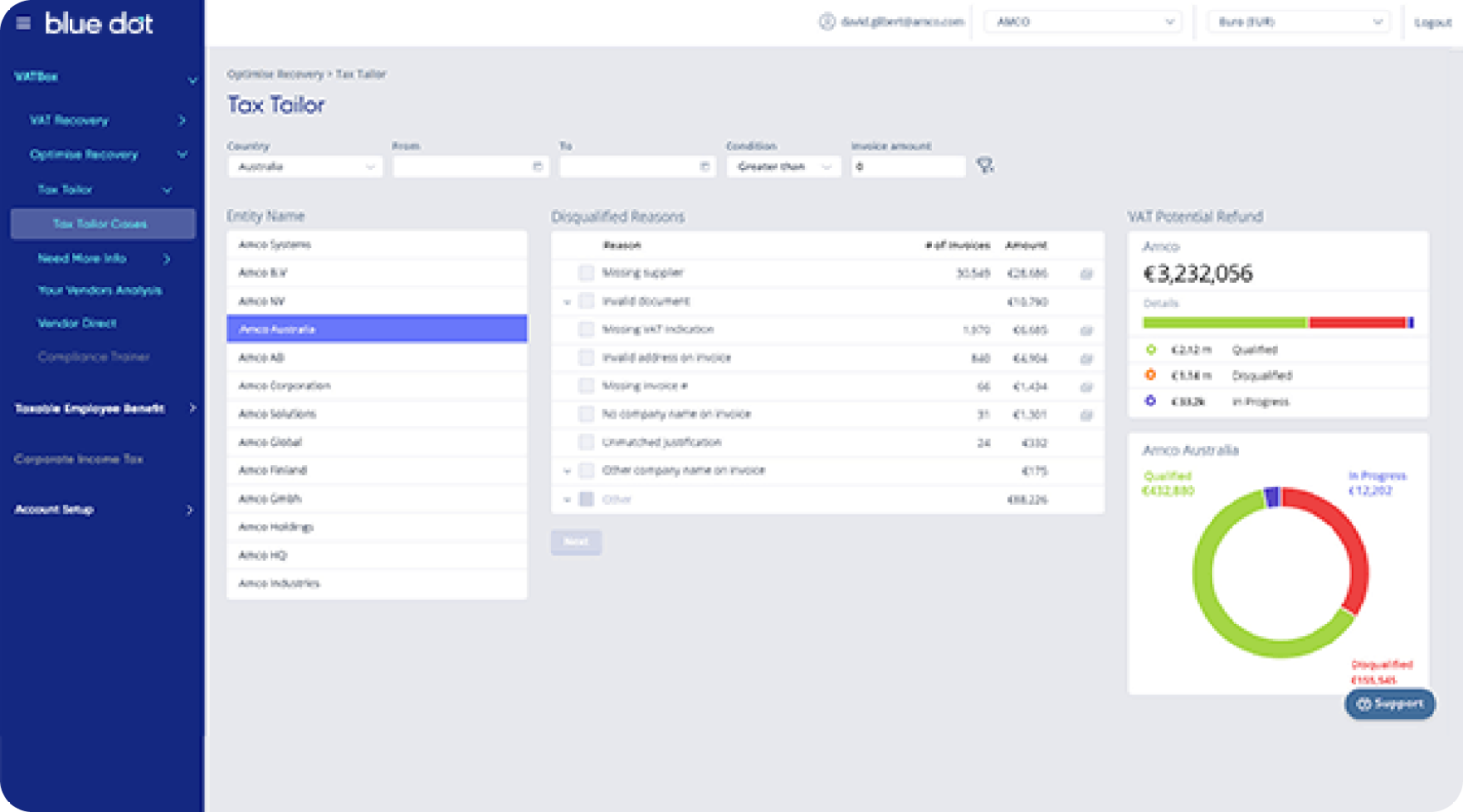

Tax tailor

- Optimise your domestic VAT recovery potential and boost your savings

- Adjust the strictness of your domestic VAT/GST returns based on your company policy and rulings with the tax authorities while maintaining full compliance

- Reduce risks and improve compliance by resolving inquiries with minimal intervention

British American Tobacco

“After a time-consuming audit by HMRC, Blue dot VATBox helped show HMRC that we’re now in control of these expense claims.”

– Andrew Davis

Head of VAT