Blue dot Ecosystem

Our strategic alliances with tier-1 partners have helped us shape our overall vision of current and new solutions, including acceleration, development, and expansion into the market.

Join our fast-growing network of channel partners, technology partners and financial consultancy partners and resellers.

Why Partner with Blue dot

Provide your customers with integrated solutions to some of the most urgent tax compliance and data integrity demands placed upon their expense management workflows.

With thousands of business units employing Blue dot technology around the globe, partnering, integrating and adopting Blue dot products into your suite of features and services can add tremendous value to your business, and theirs. Reducing churn, increasing revenues, and streamlining systems interoperability translate into optimal efficiency, dependability, and peace of mind.

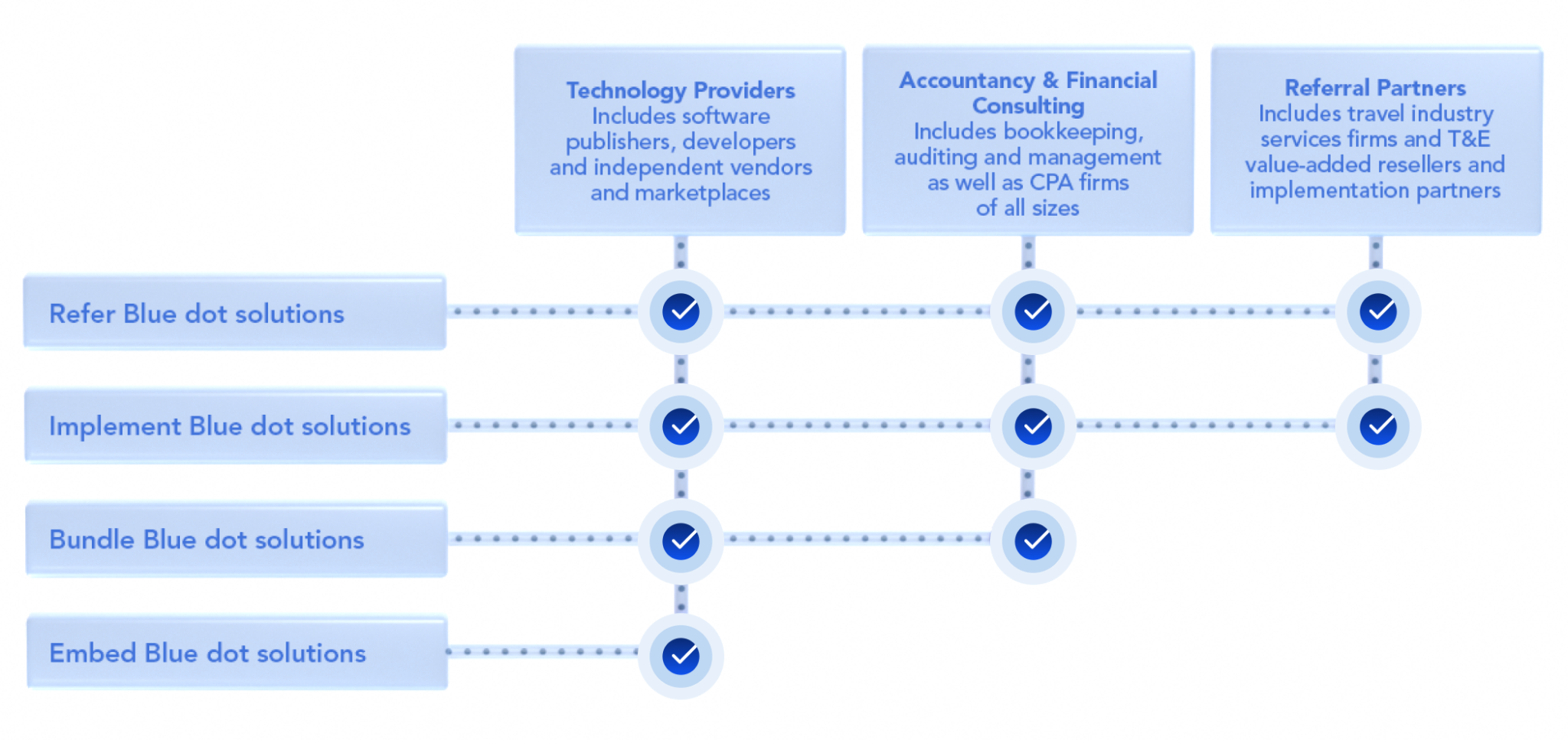

TECHNOLOGY PARTNERS

Accountancy & financial services firms

referral partners

TECHNOLOGY PARTNERS

An automated tax solution that works with your platform.

As a spend management technology provider, you strive to provide a seamless experience for your customers. Providing customers with a seamless experience means expanding your solutions portfolio, so they don’t need to look any further. When it comes to managing VAT and Benefits Tax, your customers as well as your prospects look to reduce friction and optimize ease of deployment in solving these business problems.

If customers choose to leave your ecosystem to manage their VAT recovery and TEB reporting needs, or they need to search for a solution on their own, you potentially are creating a customer service issue and also a missed revenue generating opportunity for your company. Blue dot can help you keep your customers close — and you’ll earn rewards from us while earning loyalty from them.

Partnering with Blue dot allows you to:

Provide a competitive advantage for your business while meeting the needs of clients who want an integrated approach that works together.

Enhance your customer service while building loyalty with your customer base.

Outsource a complex problem to the industry leader – why waste time and resources trying to build complex functionality when you don’t need to?

While saving on your development budget, why not generate additional revenue for your business?

Accountancy and financial services firms

Expand your tax practice.

Many businesses miss the opportunity to recover VAT (both domestic and foreign) that is eligible to be recouped or report on Taxable Employee Benefits (TEB) from expenses that are initiated through employee driven spend. Most companies don’t have the knowledge or the staff time to do it on their own. Accounting and financial services firms lack the tools to help and tend to provide low margin manual services to support their customers. Blue dot makes life easier for both you and your client by providing an automated, technology-first solution that solves all of your clients’ complicated VAT recovery and TEB reporting needs.

Partnering with Blue dot allows you to:

Boost your client’s bottom line

Add another service offering for your practice

Focus on more profitable parts of your practice, while still supporting client needs and expectations

Diversify revenue streams with little investment or effort

referral partners

Deliver the automated VAT recovery and TEB reporting solutions your customers want.

If you’re a travel industry referral partner, T&E Value Added Reseller (VAR) / Implementation partner, or a general services provider in need of a Blue dot solution, and you don’t offer VAT recovery automation or TEB reporting solution, your customers are going to look for it elsewhere. Blue dot solutions do more than make tax compliance around employee spend easier for users — Blue dot was designed to help businesses like yours better serve your clients while simultaneously providing you with an additional revenue stream.

Partnering with Blue dot allows you to:

Be the trusted advisor for your client and round out your offering with comprehensive VAT recovery and TEB reporting solutions

Create new sources of revenue for your business with our incentive programs

Meet customer expectations for integrated products that solve a specific business need

Learn more about some of Blue dot’s partners and integrations